Small-cap stock Nse: Greenpower Company Limited (NSE: Greenpower) has a market worth of $9.84 billion. Investors tend to concentrate on small-cap companies’ development potential and competitive environment. Still, they overlook one crucial factor that can threaten their survival: financial health. Why is it essential? Given that it is not profitable, it is vital to assess GREEN POWER’s existing operations and the road to profitability. Here are some simple financial health checks you should think about performing before committing.

Table of Contents

Does Nse: Greenpower Generate Enough Cash Through Operations?

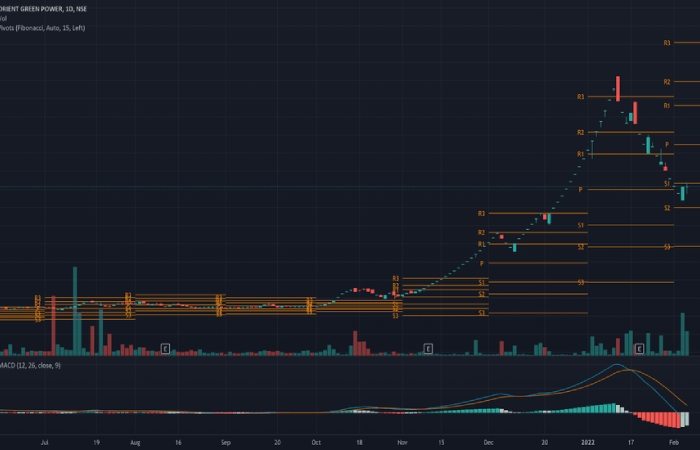

Nse: Greenpower has constant its debt level by about ₹19,602.6M over the last 12 months, comprised of current and long-term debt. At this consistent level of debt, the current cash and short-term investment levels stand at ₹139.8M for investing in the business. During the same period, GREEN POWER generated an operating cash flow of 3,061.5M, resulting in an operational cash-to-total debt ratio of 15.62%. The amount of active cash that Nse: Greenpower has is insufficient to pay down the debt. Due to the requirement of positive earnings for traditional measurements like return on asset (ROA), this ratio can also indicate operational effectiveness for loss-making businesses. In the instance of Greenpower, it can produce 0.16 times as much cash from its loan capital.

Can Nse: Greenpower Meet Its Short-Term Obligations With The Cash In Hand?

At the current liabilities level of ₹8,886.8M liabilities, it appears that the company is not able to meet these obligations given the status of current assets of ₹2,824.2M, with a current ratio of 0.32x below the prudent level of 3x.

Does GREENPOWER Run the Risk of Imploding Under the Weight of its Debt?

Nse: Greenpower is highly leveraged since its overall debt levels have risen faster than its stock price. This is common for small-cap companies because debt is often a quicker and less expensive source of finance for some companies. However, the viability of Nse: Greenpower’s existing activities is uncertain, given that it is now loss-making. Maintaining a large debt load can be risky when sales are still below costs because unanticipated downturns tend to cause cash to dry up.

Next Steps:

With a high level of debt on its balance sheet, Nse: Greenpower could still be in a financially strong position if its cash flow is also stacked up. However, this isn’t the case, and there’s room for GREENPOWER to increase its operational efficiency. In addition, the firm may be incapable of paying all its upcoming liabilities from its current short-term assets. This is a reasonably fundamental analysis of GREENPOWER’s financial health and other essential fundamentals. I recommend you continue to research Orient Green Power to get a more holistic view of the stock by looking at the following:

- Valuation: What is Nse: Greenpower worth today? Is the stock undervalued, even when its growth outlook factor into its intrinsic value? The inherent value infographic in our free research report helps visualize whether the market currently misprices Greenpower.

- Historical Performance: What have Nse: Greenpower ‘s returns been like over the past? Review more aspects of the past track record analysis and look at our analysis’s free visual representations for more clarity.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records

Analysis for Orient GreenPower (Nse: Greenpower)

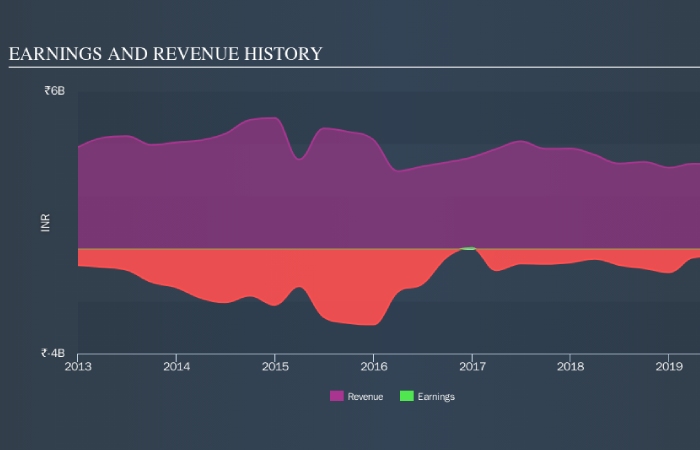

Nse: Greenpower isn’t profitable, so most analysts would look to income growth to know how fast the fundamental business grows. When a company doesn’t make profits, we usually expect good revenue growth. As you can imagine, fast revenue growth, when upheld, often leads to rapid profit growth.

In the last five years, Nse: Greenpower saw its yearly revenue shrink by 7.1%. While far from catastrophic, that is not good. The share price fall of 28% (per year, over five years) is a stern reminder that money-losing companies expect to grow revenue. It takes a certain mental fortitude (or recklessness) to buy shares in a company that loses money and doesn’t grow revenue. Fear of becoming a ‘bagholder’ may keep people away from this stock.

How Respectable Is Orient GreenPower Company Limited (NSE: GREENPOWER) When It Comes To ROE?

The numerous metrics that are helpful when analyzing a stock are still new to many investors. This article explains Return on Equity (ROE) for those interested. Through a practical example, we’ll use ROE to investigate Orient Green Power Company Limited (NSE: GREENPOWER).

Return on equity or ROE is an essential factor to be considered by a shareholder because it tells them how effectively their capital reinvests. In simpler terms, it measures a company’s profitability concerning shareholder’s equity.

How To Estimate Return On Equity?

The formula for ROE is:

Net profit (from ongoing operations) ÷ stockholders’ equity = return on equity.

So, created on the above formula, the ROE for Orient Green Power is:

7.4% = ₹375m ÷ ₹5.1b (Based on the trailing twelve months to December 2021).

The ‘return’ is the income over the last twelve months. That means that for every ₹1 worth of shareholders’ equity, the company generated ₹0.07 in profit.

Does Orient GreenPower Have A Good ROE?

We can immediately assess a company’s performance by contrasting its ROE with that of the sector as a whole. Significantly, this is far from a perfect measure because companies differ significantly within the same industry classification. shows that Nse: Greenpower has an ROE roughly aligned with the Renewable Energy industry average (6.2%).

That isn’t amazing, but it is respectable. Even if the ROE is decent compared to the industry, it’s worth checking if high debt levels aid the firm’s ROE. If true, it is more an indication of risk than the potential. Our chances dashboards should have the three risks we have identified for Orient Green Power. ( Nse: Greenpower)

How Does ROE Affect Debt?

Most businesses require funding from someplace to increase their earnings, which may come from loans, retained earnings, or the issuance of shares. The ROE will show this investment in growth for the first and second alternatives. In the latter scenario, using debt will increase returns but leave equity the same. This way, debt usage will increase ROE even while the business’s fundamental economics remain the same.

Orient Green Power’s Debt And Its 7.4% ROE

Its value notes the high use of debt by Nse: Greenpower, leading to its debt-to-equity ratio of 2.51. The mixture of a relatively low ROE and effective use of debt is not chiefly appealing. Debt brings additional risk, so it’s only valuable when a company makes decent returns.

Conclusion

Vigorblog discussed some essential aspects of Nse: Greenpower in the following article. We hope you found the content above informative and helpful, and please keep visiting our website to read more informative articles.